charitable gift annuity tax reporting

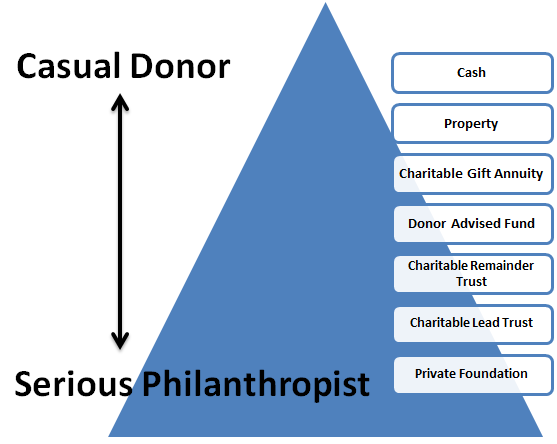

For federal tax purposes this trust is treated as a grantor trust. Charitable Trusts Charitable Lead Trust.

An indexed annuity also known as a fixed-index or equity-indexed annuity features income payments tied to a stock index such as the SP 500.

. Interest earned within an indexed annuity is tax deferred. You wont pay state or federal income tax on the interest until you withdraw it. A charitable lead trust pays an annuity or unitrust interest to a designated charity for a specified term of years the charitable term with the remainder ultimately distributed to non-charitable beneficiaries.

Life Income Plans University Of Maine Foundation

9 Taxation Of Charitable Gift Annuities Part 2 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

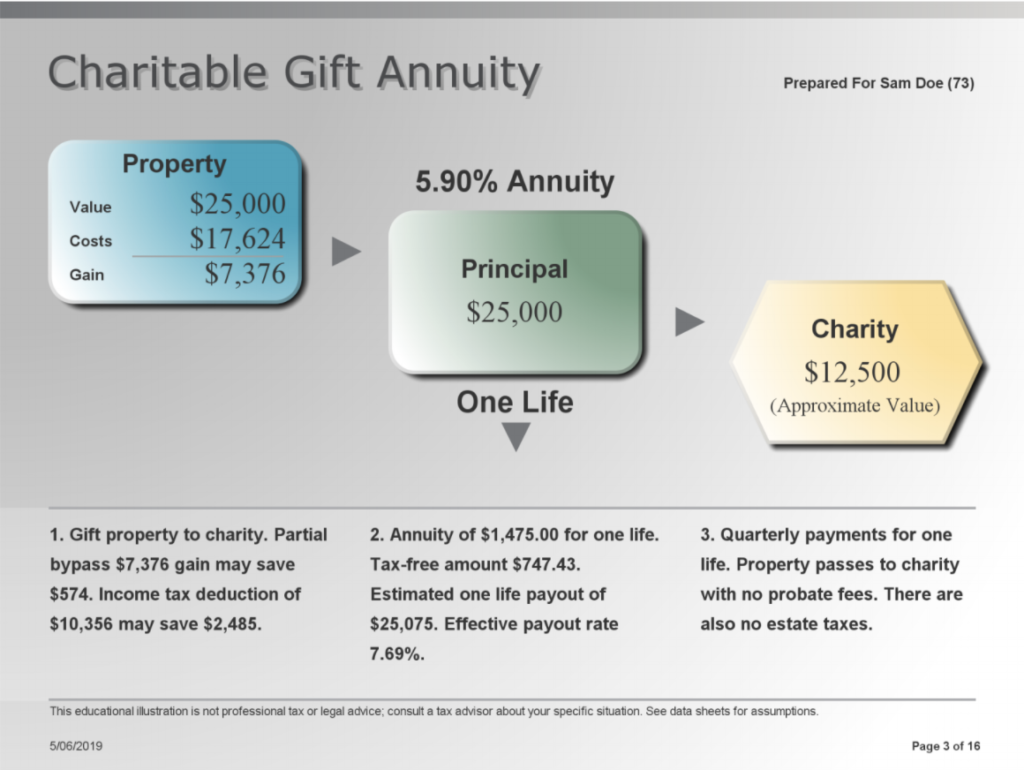

Charitable Gift Annuities Uses Selling Regulations

Gift Annuities Catholic Charities Usa

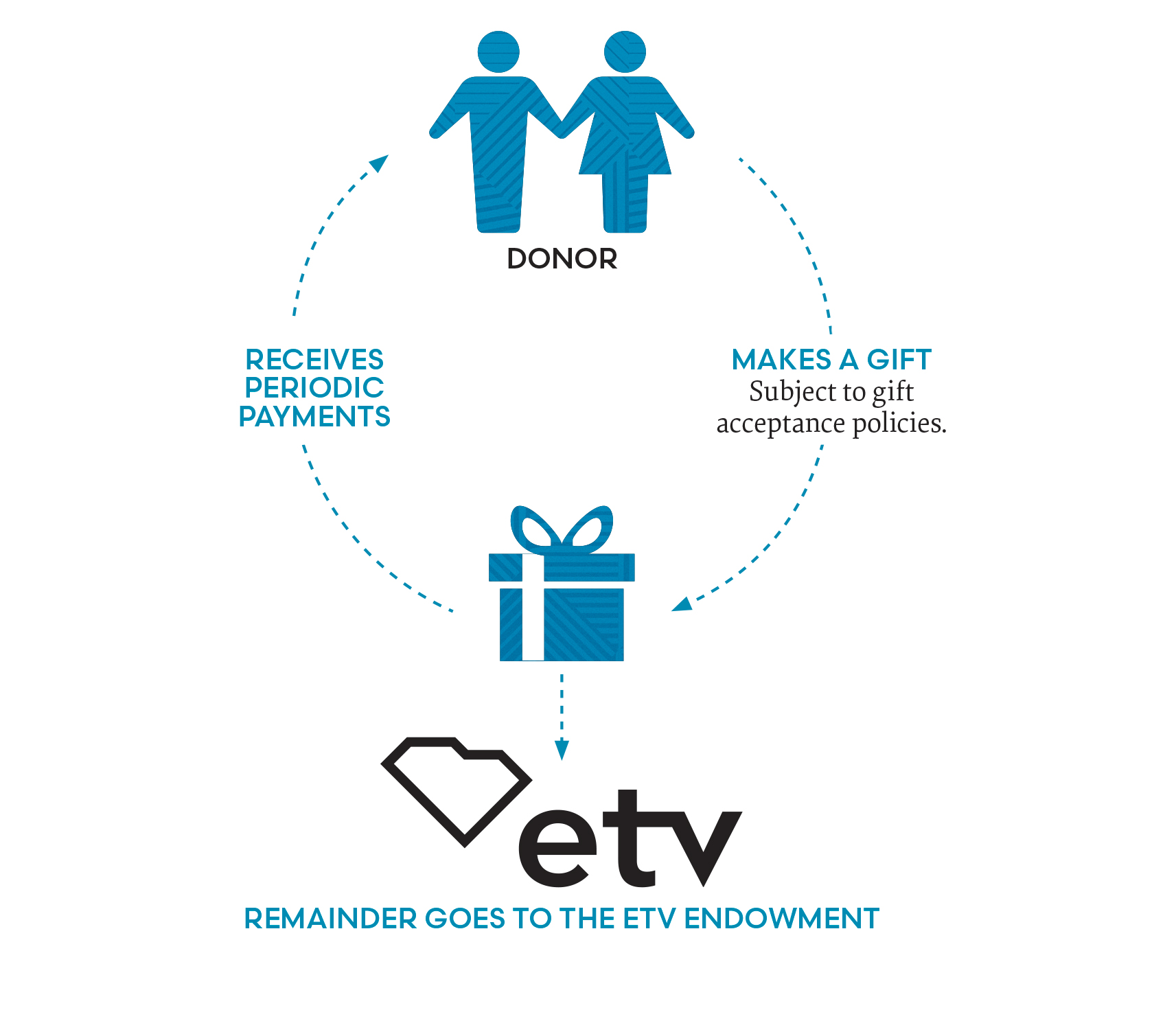

Charitable Gift Annuity Etv Endowment Of South Carolina

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuity Thinktv

How Do I Deduct A Gift Annuity To A Charity

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Gifts That Provide Income Maine Organic Farmers And Gardeners

City Of Hope Planned Giving Annuity

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Tools Techniques 101 The Charitable Gift Annuity Withum

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center